C

R

Y

P

T

O

V

A

L

L

E

Y

E

X

C

H

A

N

G

E

Testnet Open: On-chain Futures Trading is live!

Be among the first to explore CVEX testnet, an on-chain futures trading platform – the market’s first and only. Discover our platform, earn achievements, and share your valuable feedback to help us enhance your trading journey.

ContinueEarn USDC and Rewards with referrals

Join our CVEX Affiliate Program and start earning XPs for exclusive rewards!

When you invite friends, you’ll secure a lifetime 20% share of their trading fees, plus an additional 10% from your 2nd-degree referrals.

The best part?

All your connections will enjoy a 10% discount on commissions when they sign up using your referral code.

MULTICHAIN: ETHEREUM, ARBITRUM, OPTIMISM & BASE

CVEX will allow collateral deposits from any native USDC-supporting blockchain with initial support for users on Ethereum, Optimism, Base and Arbitrum depositing USDC using common wallets including MetaMask.

MORE THAN 1000x LEVERAGE

You have the opportunity to trade with huge leverage across your portfolio and access significantly higher amounts of transactions simultaneously.

74x

You hold a position of Long $500 of Bitcoin

Dec 23 Futures. With a Margin requirement of $25.25, a 1:19.8 ratio. This Margin

requirement can be reduced by adding an correlating trade:

You add a short position of

$392 worth of Dec 23 Ethereum Futures. The correlation offset

for these is nearly 50%. The collateral requirement is reduced by the correlated position.

Margin requirement is now $12.00.

Effective leverage for this simple portfolio 74X

291X

You go long $500 worth of Dec 23 BitcoinFutures.You buy a Put Ladder of

options to capture downside value, each for $1000 notional. Puts @25,000; 23,000; 20,000;

respectively. Total Notional position, $3500.

The margin on a CEX or DEX with no

portfolio risk is circa $350. Put option margin requirement produces a delta offset against

the future of 76%. The margin requirement is reduced to $12.

Effective leverage for

this simple portfolio is 291X and 30 times better than a

typical CEX.

Trade crypto & commodities

Seamlessly merging crypto and

commodities, let you explore an array of assets, from almost all cryptocurrencies in the market to

commodities like Gold, Silver and Coffee.

All you need to have is USDC.

Var portfolio management

Value-at-Risk calculations

As positions open, your required

collateral adjusts in real-time through advanced risk evaluation known as Value-at-Risk (VaR)

calculations, all without intervention.

VaR calculations analyze potential market

fluctuations, ensuring collateral utilization for margin is appropriate to the market volatility.

Manage risk by adding or withdrawing collateral, while a liquidation protocol protects users from

failures of other market users.

Open position

Open position

Cross margin

Margin capability

CVEX offers cross margin capability,

with margin offset given by historical correlation for futures with the addition of delta offset for

options. This significantly reduces the collateral requirement, with bigger books of positions

benefiting the most from offsets.

Variation margin, allocation of collateral between users

pools is handled dynamically and in real-time, meaning profits from positions can be immediately

realised.

Your money is only yours

Zero Fees Withdrawals

Efficient Trading Costs

Gas Free Trades

How we differentiate

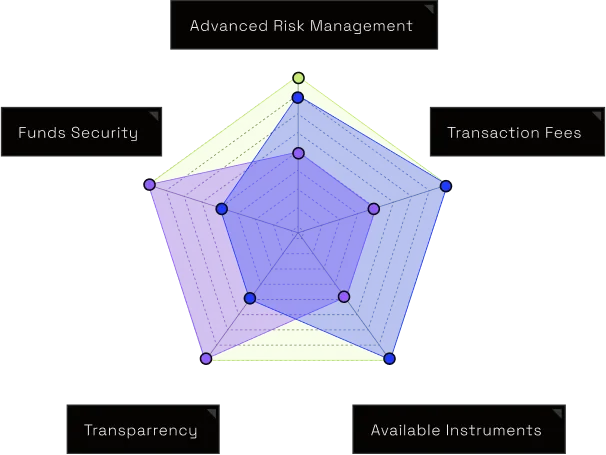

ANALYTICAL INSIGHTS CHART

This chart is an analytical overview based solely on our research and findings, providing insights into the CVEX, CEX and DEX platforms.

A MASSIVE OPPORTUNITY

Revolutionizing the world’s largest asset market. Global derivatives totals to $132,000,000,000,000 ($132 trillion).

Derivatives pose a massive opportunity

to drive institutional crypto adoption, the crypto derivatives market will be the largest crypto

market.

True decentralized, on-chain futures & options trading offers a wealth of

opportunity.

Source: (1) FIA.org, Total Exchange Traded

Derivatives (ETD), January 2023, ±$132 Trillion Based On A 100,000 Average Notional Value. (2) BIS.org, Global OTC Derivatives Market, H1 2022, ±$632 Trillion.

Team behind cvex

Mathias is a seasoned award-winning tech

entrepreneur with a deep technical knowledge in crypto and blockchain. He has lectured at several

notable conferences including Blockchain Summit London, ITU (United Nations tech conference) and

TEDx.

His track record includes multiple tech startups, three exits and one IPO. BTC

investor since early 2015 and he holds a degree from the triple accredited Henley Business School

in the UK.

James has over 25 years of experience in the

traditional finance and DeFi industries, holding several C-Suite roles with companies such as

Crypterium, Coindirect and the London Derivatives Exchange.

He is an expert in derivatives

and related products, with direct involvement in the development of a wide range of products

holding several C-Suite and senior roles with companies such as London Derivatives Exchange,

Trayport and Cantor Fitzgerald.

Ivan is a highly experienced solution architect and

principal engineer with over 12 years of experience in the industry.

He is well regarded in

the Rust open-source community and has designed and implemented a host of advanced systems in the

blockchain space including Exonum blockchain as ex Chief Architect at Bitfury. Focusing on

innovative, large-scale products, he has designed, implemented and delivered reliable and

efficient solutions for a number of advanced projects in the blockchain space.

Jules is an award-winning investor and entrepreneur

with over 20 years of experience across investment banking, private equity, venture capital, and

leading startups and scaleups.

He has invested in, founded, and managed high growth

businesses in emerging technologies, fintech, AI, and crypto and participated in over $20 billion

in debt and equity funding.

First degree from Oxford University. MBA from

INSEAD.

CFO and COO experience working with boards. Focused on blockchain since 2016

supporting enterprise solutions, DeFi, and Layer 1 protocols.

Ivan is a seasoned marketing professional with over

4 years of expertise in the Web3 industry.

Renowned for his pivotal roles in Allbridge,

LetsExchange, and GoodCrypto App, he is a visionary leader known for orchestrating highly

successful marketing campaigns.

Ivan’s innovative strategies have consistently propelled

DeFi projects to millions in volume and liquidity, making him a key contributor to the success of

prominent Web3 ventures.

Brendan is a highly experienced TradFi and Fintech

leader and co-author of FinTech for Dummies and author of ESG Investing for Dummies.

He is

the former Chief Innovation Officer, Global Head of Product Strategy and Executive Board Member at

Eurex, which is one of the largest futures and options markets in the world, and Chairman of the

Supervisory Board Deutsche Boerse Asia.

Eduardo is ex-Binance Director of Institutional

Sales EMEA & LATAM. He is an experienced professional with a demonstrated history of working

in the technology and financial services industry.

Started his career in International

Banking, to then do 360 degrees transition to the startup life in crypto. Joined as founding team

member at IntoTheBlock in 2018, leading the BD & Marketing efforts until 2020 when decided to

join Binance to lead the Institutional team in EMEA & Latam up until his departure in

late 2023.

During his tenure in Binance, Eduardo worked closely with a wide range of market

participants, including; individual traders, HFT and proprietary trading firms, hedge funds, asset

managers and family offices, market makers and brokers, investment banks, corporations, fintech

firms, and more.

Total Headcount

[ Remote & On-site Team ]

Crypto Valley Exchange is built by a team of experienced advisors, traders, developers and marketers with decades of experience in the TradFi and DeFi markets.

SCALING LAYER-2 WITH ARBITRUM

Efficiency

Speed

Economical

Accessible

Scalable

Frequently asked questions

What is Crypto Valley Exchange (CVEX)?

Crypto Valley Exchange (CVEX) is a pioneering force in the Decentralized Derivatives Exchanges (DDEX) space, offering a novel approach to futures and options trading within the decentralised finance.

What are the fees associated with CVEX?

What's the advantage of using CVEX over other exchanges?

Who is behind CVEX?

How does CVEX handle risk management?

How can I stay updated on CVEX news and developments?

Does CVEX offer a referral or affiliate program for users to earn rewards by inviting others?

STAY UP TO DATE

Stay up to date with all the latest news and developments from the CVEX team. Join the waitlist to get Early Access.

.png)